Analyze and Parse the Google Pay Data For Credit and Debit Card Payments | Data Analytics

- realcode4you

- Dec 21, 2021

- 2 min read

Business context

Deel clients may add funds to their Deel account using their credit and debit cards. Deel has partnered with Globepay to process all of these account funding credit and debit card transactions. Globepay is an industry leading global payment processor and is able to process payments in many currencies from cards domiciled in many countries. Deel has connectivity into Globepay using their API. Deel clients provide their credit and debit details within the Deel web application, Deel systems pass those credentials along with any relevant transaction details to Globepay for processing.

Problem

Deel is experiencing a decline in the acceptance rate of credit and debit card payments processed by Globepay in the recent period. The “acceptance rate” is defined as the number of accepted transactions divided by the total attempted transactions.

Relevant files:

Acceptance report

Chargeback report

globepay_api.html

Acceptance Data:

Chargeback Data:

The candidate is free to use Excel or any scripting language to parse and analyse The data. Please show all your work (including your code if applicable) and assumptions as well as provide a pdf / keynote with your findings (outcomes).

Globepay is single and secure payment platform that lets you collect payments quickly from around the world in different currencies. It works across devices and is designed to increase your conversion.

Globepay makes it easy to build a first-class global payments experience:

Designed to remove friction—Real-time card validation with built-in error messaging Mobile-ready—Fully responsive design

International—Supports 15 languages and multiple payment currencies

Customization and branding—Customizable buttons and background color

Fraud and compliance—Simplified PCI compliance and SCA-ready

Additional features—Collect addresses, send email receipts, and more

API Reference

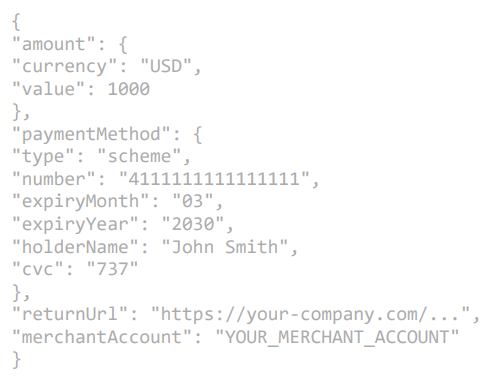

Send payment parameters (like amount, country, and currency) together with the input details collected from the customer to Globepay.

Payment Request parameters

amount: The amount information for the transaction (in minor units).

currency: The three-character ISO currency code.

amount: The amount that will be charged to the card.

paymentMethod: The payment method used in the transaction.

type: The type of payment method used in the transaction, e.g Visa

number: The payment card number of payment method used in the transaction

expiryMonth: The card expiry month. Format: 2 digits, zero-padded for single digits. For example: 03 = March, 11 = November

expiryYear: The card expiry year. Format: 4 digits. For example: 2020

cardHolderName: The cardholder name passed in the payment request.

CVC: Card verification value. optional but recommended

Payment Response parameters

The response returns the result of the payment request:

external_ref: The card expiry year. Format: 4 digits. For example: 2020

date_time: The timestamp of the transaction.

state: The binary state of the transaction. For example: Accepted or Declined.

chargeback: If the transaction has been chargedback. For example: True or False

amount: The amount that has been charged from the card.

currency: The three-character ISO currency code.

country: The two-character ISO country code of the card.

rates: The exchange rate used. Funds are settled to you in USD.

merchantReference: Your order number

...

If you need any other help related to Data Analytics Using Python Machine Learning then we are ready to help you.

Contact Us: +91 82 67 81 38 69

Send Details At: realcode4you@gmail.com

Comments